How Local Governments Allocate Tax Dollars: A Budget Deep Dive

Understanding how your local government allocates tax dollars involves examining the budgeting process, which includes public input, departmental requests, and council decisions, ultimately determining how funds are distributed across essential services and community projects.

Ever wondered how your local government allocates tax dollars? A Deep Dive into the Budgeting Process is essential for understanding where your money goes and how it impacts your community. Let’s explore the nuts and bolts of local government budgeting.

Understanding the Budgeting Process

The budgeting process is the backbone of local governance. It determines how public funds are distributed and utilized. Transparency and community input are crucial for ensuring these funds are allocated effectively.

Understanding this process empowers citizens to engage with their local government and advocate for their priorities.

Key Stages of the Budgeting Process

The budgeting process isn’t a single event but a series of stages. Each stage plays a crucial role in shaping the final budget.

- Preparation: Government departments prepare their budget requests, outlining projected expenses and proposed projects.

- Review & Approval: The city council or equivalent body reviews these requests, often holding public hearings to gather community input.

- Implementation: Once approved, the budget is implemented, and funds are allocated to various departments and projects.

- Evaluation: Throughout the year, the budget is monitored, and adjustments may be made based on changing needs and priorities.

The evaluation stage ensures that the budget remains responsive and effective.

The budgeting process is cyclical, with each year building on the lessons and experiences of the previous one. Understanding this cycle helps citizens better advocate for their needs.

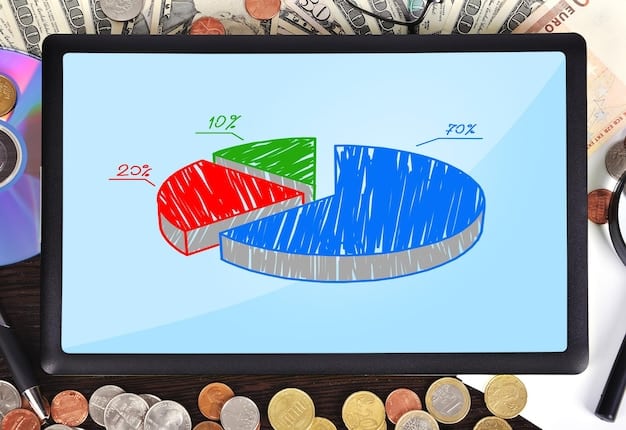

Major Expenditure Categories

Local government budgets cover a wide range of services and projects. Understanding these major expenditure categories is essential for appreciating where tax dollars go.

These categories typically encompass essential services that impact residents’ daily lives.

Education

A significant portion of local government budgets is allocated to education. This includes funding for public schools, libraries, and other educational programs.

These funds support teacher salaries, educational resources, and infrastructure maintenance.

Public Safety

Public safety encompasses police, fire, and emergency medical services. These departments require substantial funding to ensure community safety and well-being.

Investments in public safety are essential for creating safe and secure neighborhoods.

Infrastructure

Infrastructure projects involve roads, bridges, water systems, and public transportation. These projects are vital for supporting economic development and quality of life.

- Road Maintenance: Regular maintenance and repairs are necessary to ensure safe and efficient transportation.

- Water Systems: Funding for water and sewer systems ensures access to clean water and proper sanitation.

- Public Transportation: Investments in public transportation can reduce traffic congestion and improve air quality.

Sustainable infrastructure is crucial for long-term community development.

These expenditure categories reflect the diverse responsibilities of local government.

Sources of Revenue

Local governments rely on various sources of revenue to fund their operations. Property taxes, sales taxes, and state aid are common sources.

These revenue sources determine the amount of funds available for budgeting.

Property Taxes

Property taxes are a primary source of revenue for many local governments. These taxes are levied on the assessed value of properties within the jurisdiction.

Property tax revenue supports essential services like schools, public safety, and infrastructure.

Sales Taxes

Sales taxes are another significant source of revenue. These taxes are collected on retail sales within the locality.

Sales tax revenue can fluctuate based on economic conditions and consumer spending habits.

State Aid

State aid refers to funding provided by the state government to local governments. This aid can support various programs and services.

The amount of state aid available can vary based on state budget priorities and economic conditions.

Understanding these revenue sources helps citizens appreciate the financial constraints and opportunities facing their local government.

Community Input and Engagement

Community input is vital for effective budget allocation. Public hearings, surveys, and online forums provide opportunities for residents to share their priorities.

Engaging with the community ensures that budget decisions reflect residents’ needs and preferences.

Public Hearings

Public hearings are a common forum for gathering community input. Residents can attend these hearings to voice their opinions and concerns.

These hearings provide a platform for government officials to hear directly from the community.

Surveys

Surveys can be used to gather feedback from a broader segment of the population. These surveys can assess residents’ priorities and preferences.

Online surveys make it easier for residents to participate and provide feedback.

Online Forums

Online forums provide an ongoing platform for community engagement. Residents can share their thoughts, ask questions, and participate in discussions.

These forums can help government officials stay informed about community concerns.

Effective community engagement leads to more responsive and equitable budget decisions.

Challenges and Trade-offs

Budget allocation involves navigating various challenges and trade-offs. Limited resources and competing priorities require careful decision-making.

Understanding these challenges helps citizens appreciate the complexities of local government budgeting.

Limited Resources

Local governments often face limited resources. The demand for services and projects can exceed the available funding.

Budget officials must prioritize essential services and make difficult choices about which projects to fund.

Competing Priorities

Different segments of the community may have competing priorities. Balancing these priorities requires careful consideration and compromise.

Budget decisions must consider the needs of diverse groups within the community.

Economic Conditions

Economic conditions can significantly impact budget allocation. Economic downturns can reduce revenue and increase demand for social services.

Budget officials must adapt to changing economic circumstances and adjust spending accordingly.

Navigating these challenges and trade-offs requires transparency and effective communication with the community.

Transparency and Accountability

Transparency and accountability are essential for building trust in local government. Providing clear and accessible budget information is crucial.

Transparency ensures that residents can understand how their tax dollars are being spent.

Open Budgeting

Open budgeting involves making budget information readily available to the public. This includes detailed budget documents, spending reports, and performance metrics.

Online portals can provide easy access to budget information.

Audits

Regular audits ensure that funds are being spent appropriately and in compliance with regulations. Audits can identify potential areas of waste or mismanagement.

Audit reports should be made available to the public.

Performance Metrics

Performance metrics provide a way to measure the effectiveness of government programs and services. These metrics can help identify areas where improvements are needed.

Tracking performance metrics enhances accountability and improves service delivery.

By prioritizing transparency and accountability, local governments can foster trust and confidence among residents.

| Key Point | Brief Description |

|---|---|

| 💰 Budgeting Process | Involves preparation, review, implementation, and evaluation stages. |

| 🏫 Major Expenditures | Includes education, public safety, and infrastructure investments. |

| налогов Revenue Sources | Property taxes, sales taxes, and state aid fund local governments. |

| 🗣️ Community Input | Public hearings, surveys, and online forums enhance budget decisions. |

Frequently Asked Questions

▼

A municipal budget is a financial plan outlining anticipated revenues and proposed expenditures for a local government over a specific period, usually one fiscal year. It details how the local government intends to allocate tax dollars to various departments and services.

▼

You can typically find your local government’s budget on its official website, often in the finance or administration section. Many local governments also provide printed copies at city hall or local libraries for public review.

▼

Understanding the municipal budget helps you know how your tax dollars are being used. This knowledge empowers you to participate in local decision-making and advocate for community needs, promoting better governance.

▼

The main revenue sources for local governments include property taxes, sales taxes, fees for services (like water and waste management), and intergovernmental transfers from state and federal governments. These funds support essential services.

▼

You can influence budget decisions by attending public hearings, contacting local representatives, participating in community surveys, and joining local advocacy groups. Engaging in these activities ensures your voice is heard.

Conclusion

Understanding how your local government allocates tax dollars is essential for informed citizenship. By engaging with the budgeting process, you can play a role in shaping your community’s future and ensuring that your tax dollars are used effectively.